Investor relations > About us > Otoczenie rynkowe

Market environment

The ED Invest S.A. Group operates in Poland, a real estate market that is considered to be developing and at the same time strongly linked to the

with the economic situation of the country. The development of the development and construction sector is closely dependent on factors such as inflation, interest rates and exchange rates. Government policy on the construction market is also of great importance. It influences the investments and projects that can be implemented at a given time.

Housing market

The Polish market is stabilizing after rapid price growth in past years. The change is the result of a number of factors, such as rising interest rates making it more difficult to access mortgages, high inflation raising the cost of housing construction, the end of the “2% Safe Credit” program and market saturation in larger cities. Economic uncertainty is also making potential buyers cautious.

In recent years, real estate price growth in Poland has been among the fastest in the entire EU. The years 2018-2023 saw a 59% increase in housing prices (20% after adjusting for consumer price inflation). The current situation has been largely influenced by government programs, such as the “2% Safe Credit” that was in operation last year, under which some 55,800 loan agreements were signed.

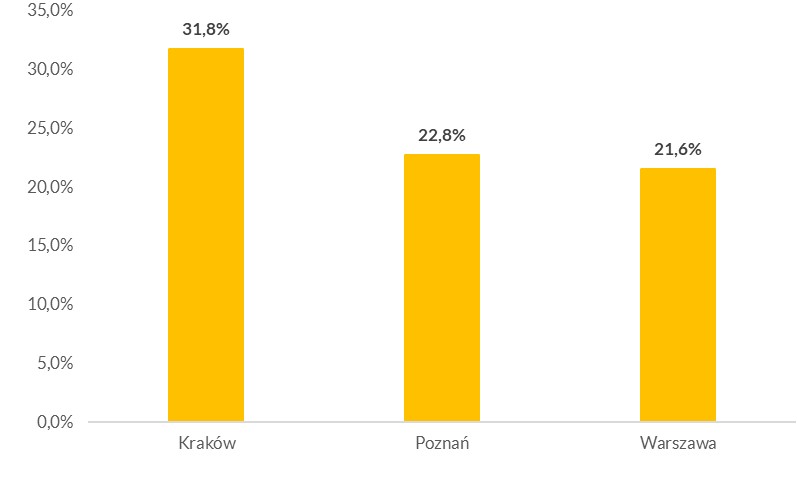

Chart 1. Growth in primary market transaction prices in Q2 2024 (y/y).

Source: https://next.gazeta.pl/pieniadz/7,188932,31226172,krakow-przegonil-warszawe-ceny-mieszkan-rosna-w-przerazajacym.html

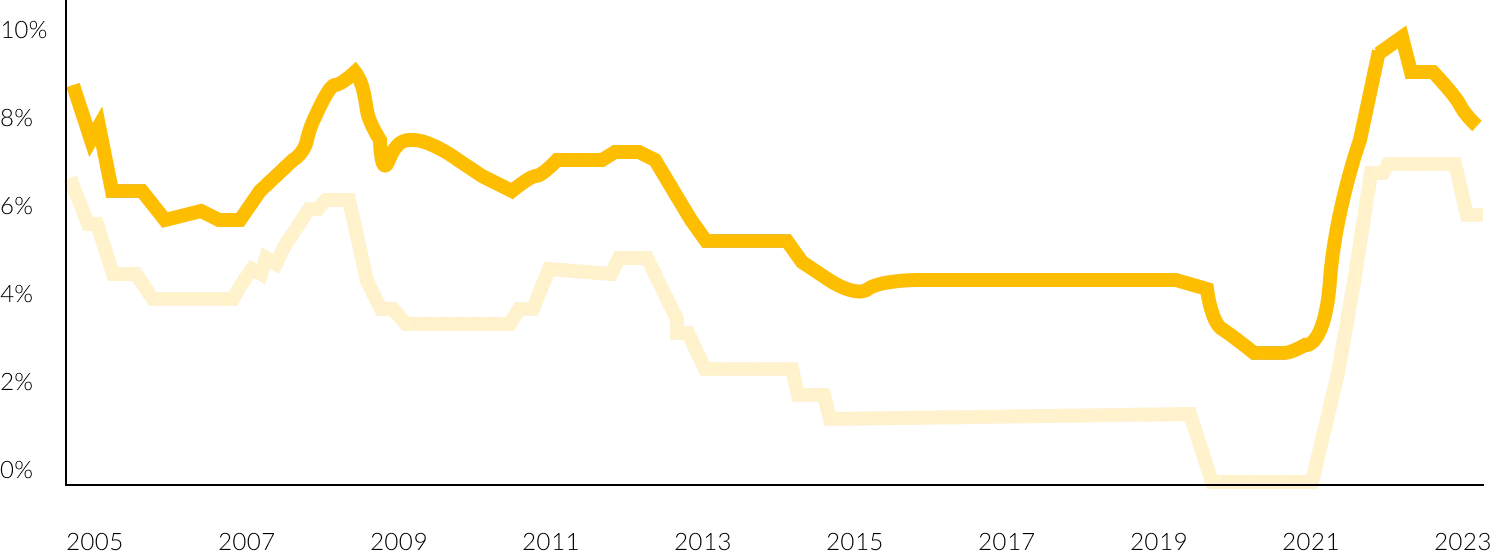

Availability of mortgage credit

One of the key challenges currently facing the housing market is the availability of mortgages. Although the average amount of mortgage applied for in September 2024 reached a record high of PLN 444,74 thousand, the number of loan applicants fell by 22% compared to the same month last year. The current level of interest rates, which is one of the highest in the European Union, significantly affects the availability of credit and thus the ability to purchase real estate.

The decline in the number of loan applications is due, among other things, to the end of the “2% Safe Credit” program, which had significantly stimulated the housing market in the past. In the absence of a new, similar support program and the high cost of credit, fewer and fewer people are choosing to buy property. An opportunity to bring them back could come from specific government actions or changes in credit conditions, such as lowering interest rates.

In Q3 2024, housing lending criteria were eased slightly and lending margins were lowered, with other lending conditions unchanged. For Q4 2024, banks do not announce any significant changes to lending criteria.

Chart 2. Interest rates for new mortgages in PLN

Source: https://www.pekao.com.pl/dam/jcr:85261eca-bc95-4b22-9f7e-608ad3394e8a/Rynek%20nieruchomo%C5%9Bci%20w%20Polsce%202024.pdf

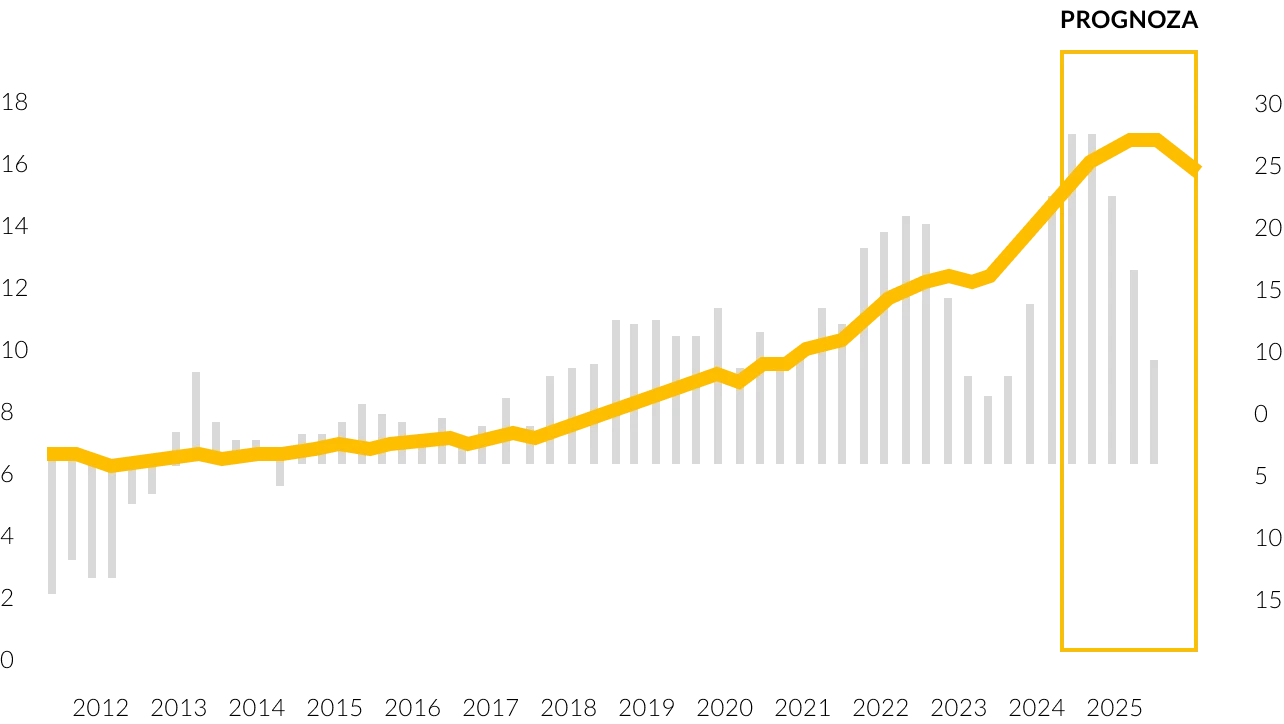

Demand vs. supply in the real estate market

Poland’s current housing base is still relatively small compared to the rest of Europe. In 2022, it numbered about 15.6 million units, meaning that statistically there were just over 400 apartments per 1,000 residents. This is one of the lower levels in the European Union – especially when compared to Western Europe, where it is usually 450. The number of units per 1,000 residents is evidence of the still relatively low saturation of the housing market, which affects the long-term demand outlook and the low risk of a “housing bubble.”

The current housing gap in Poland is estimated at more than one million units. According to data from the Central Statistical Office, 220,379 housing units were completed nationwide in 2023, the lowest result in four years, while developers started construction of only 114,526 new units, the lowest result since 2017. The total number of new developments also declined compared to the previous year, reaching 189,093.

Chart 3. Prices of flats from the primary market according to NBP data (7 largest cities) with forecast.

Source: https://www.pekao.com.pl/dam/jcr:85261eca-bc95-4b22-9f7e-608ad3394e8a/Rynek%20nieruchomo%C5%9Bci%20w%20Polsce%202024.pdf

Developer activity

As of August 1, new provisions of the Construction Law came into force, which significantly change the form and scope of the construction project. These changes are aimed at simplifying administrative procedures, as well as increasing the transparency and efficiency of the construction process. The new guidelines clearly define what elements must be included in a construction project, which reduces the number of documents required to obtain a construction permit. With better coordination between offices, administrative procedures are expected to become friendlier for investors and developers.

In the three quarters of this year, fewer apartments were completed than a year ago. On the other hand, there were many more apartments for the construction of which permits were issued or notifications were made with a construction project, as well as apartments whose construction had begun. In September this year, the number of apartments completed was higher than a year earlier. However, for the first time in a year, there was a slight decrease in the number of apartments for which permits were issued or notifications were made with a construction project. However, there were slightly more apartments whose construction had begun than in September last year.

Forecasted changes

Forecasts for Q4 2024 indicate that the housing market in Poland will continue to stabilize, although further price adjustments cannot be ruled out.

In cities where the offer is wide and demand is limited, such as Poznań or Łódź, further price declines are possible. On the other hand, in locations such as Warsaw or Tricity, where demand remains relatively high, prices may remain stable.

Forecasts assume that fewer and fewer people will rely on government support programs, and price stability and possible interest rate cuts could spur demand. Some buyers, tired of waiting for more favorable credit terms or new support programs, will decide to buy property.

As a result, developers may seek to increase sales, especially in cities where the range of apartments is wide and prices remain competitive. Ultimately, everything will depend on the macroeconomic situation, including possible interest rate cuts that could improve mortgage availability.