Investor relations > About us > Market environment

Market environment

The ED Invest S.A. Group operates in Poland on the real estate market, which remains strongly linked to the overall economic condition of the country. Key factors affecting the development and construction sector include GDP growth, inflation, interest rates, and government policy on the housing market and government programmes.

According to official data from the Central Statistical Office (GUS), in Q3 2025, Poland’s gross domestic product (GDP) reached 3.7% year-on-year, an increase of 0.8% compared to Q2. These data confirm Poland’s sustained economic growth, are in line with economists’ forecasts, and indicate a significant acceleration compared to previous months. This is the highest result in nearly three years.

Housing market

The year 2025 brings a continuation of the trends observed in previous years on the Polish residential property market. Despite gradual stabilisation, the sector remains influenced by a number of macroeconomic and regulatory factors, as well as the ever-changing individual preferences of buyers.

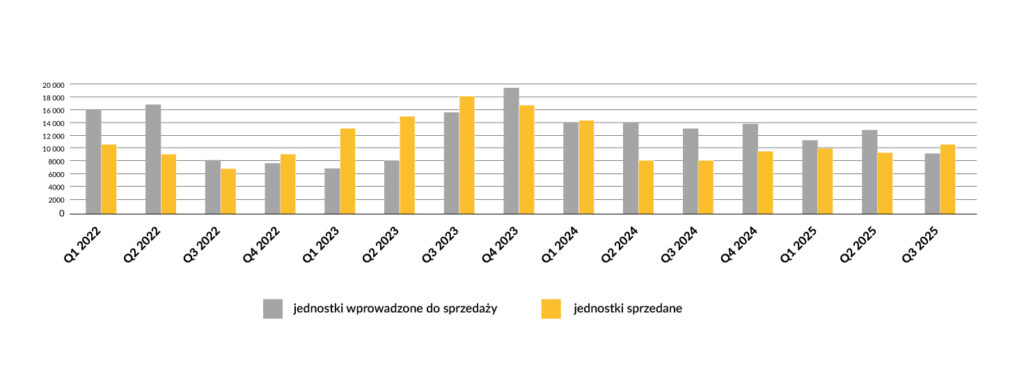

Despite fluctuations in the number of building permits issued in Q3 2025 (July and August – decrease, September – increase), the total number of residential units available on the primary market in Poland remained at a similar level to Q2, amounting to approximately 60,000 flats. Compared to the end of June, the supply decreased by less than 1,500, or 2.4%. During this period, developers in the six largest agglomerations (Warsaw, Kraków, Wrocław, Tricity, Poznań, Łódź), introduced less than 9,500 new flats (23% less than in the previous quarter), while over 10,800 units were sold (8% more than in Q2 2025).

Chart 1. Quarterly demand and supply relationship in Q3 2025 (aggregation for 6 markets: Warsaw, Krakow, Wroclaw, Tricity, Poznan, Lodz).

Source: Living-Poland Warsaw Q3 2025 report – CBRE.

Availability of mortgage credit

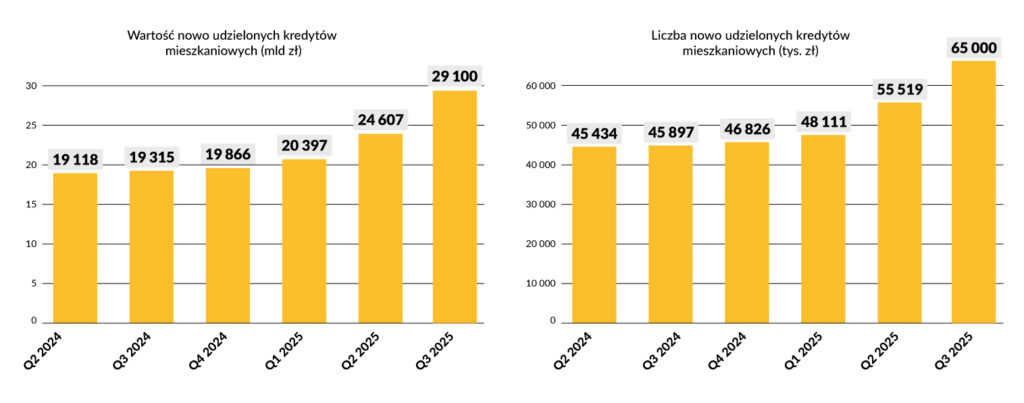

In Q3 2025, despite the moderately favourable environment for the housing market, inflation close to the target and further interest rate cuts translated into a further significant improvement in loan financing conditions. Over 116,000 applications were submitted, representing a 36% increase compared to the same period last year. In September alone, a record number of nearly 41,000 applications were recorded (an increase of 42.2% year-on-year and the best result in over two years), and the number of applicants increased by approximately 39,900 (+40% year-on-year). The total number of housing loans granted in Poland in the period July-September 2025 amounted to almost 65,000 (17% more than in Q2) and amounted to a record sum of over PLN 29.1 billion, i.e. an increase of almost 1/5.

The significant increase in the availability of loans, especially in Q3 2025, was due to improved financing conditions. Banks continued to liberalise their lending policies, mainly by lowering margins in response to interest rate cuts. In May this year, the reference rate fell by 0.5 percentage points, in July by 0.25 percentage points (to 5.00%), and then in September by another 0.25 percentage points (to 4.75%), making mortgage instalments lower. Finally, in Q3 2025, the reference rate in Poland was 4.75%. All this resulted in an increase in creditworthiness and a noticeable decrease in financing costs.

Chart 2. Total value and number of new housing loans granted in Q3 2025 (in thousands).

Source: AMRON-SERFiN report – nationwide report on housing loans and property transaction prices No. 3/2025

Apartment prices

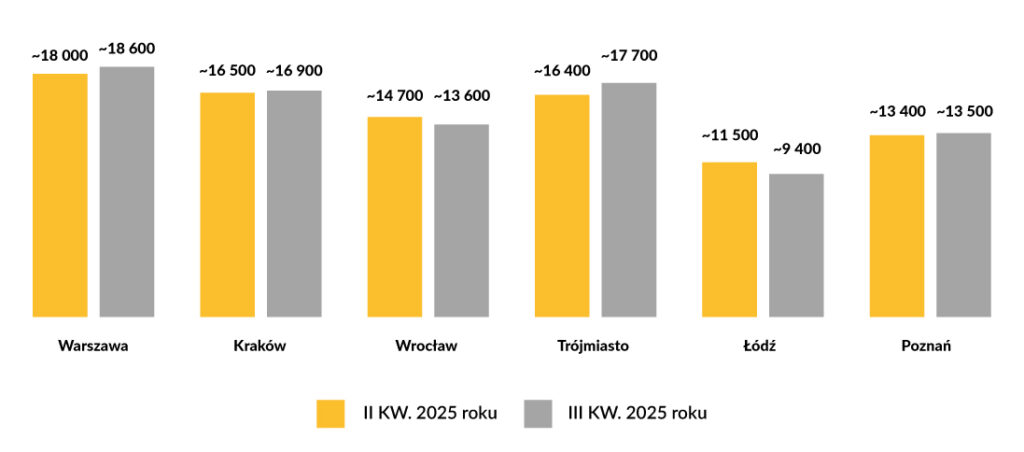

The flat sales market in Q3 2025 maintained the price dynamics observed in the previous quarter, i.e. prices were generally stable or only slightly higher. In four of the six largest cities in Poland, average transaction prices per square metre increased slightly, with the highest increase of 2.5% in Gdańsk. In contrast, Łódź and Wrocław saw slight declines of 2% and just over 1% (compared to Q2 this year).

Thus, the average price per square metre in Q3 2025 was: in Warsaw ~PLN 18,600/m² (approx. +0.5% q/q), Kraków ~PLN 16,900 per square metre (≈0% q/q), Wrocław ~PLN 13,600 per square metre (-1.5% q/q), Łódź ~PLN 9,366 per square metre (approx. -2% q/q), the Tri-City ~PLN 17,700 per square metre (+2% q/q) and Poznań ~PLN 13,500 per square metre (≈0% q/q).

Overall, slightly greater price fluctuations were recorded in large regional cities, but everywhere the changes in the average price of flats, both quarterly and annually, were in the single digits – in most cases not exceeding 5%.

Chart 2. Average prices of apartments offered on the primary market in Q3 2025 (in PLN/m2, with VAT, in developer standard).

Source: JLL Report – nationwide report on the housing market in Poland, “Research Poland, Third Quarter 2025.”

Developer activity

The continuing growth in demand, driven in part by a significant improvement in credit financing conditions (especially after further interest rate cuts and reductions in bank margins), is a clear signal to developers that the number of flats sold in the coming fourth quarter should increase.

The second quarter of 2025 was characterised by increased optimism among sellers, but it was the third quarter that brought the highest profits to date. Flat sales in the largest cities increased by 8% compared to the second quarter, and further growth is expected.

The housing market in Poland in Q3 2025 was characterised by stable supply. In addition, the entry into force in July 2025 of price list transparency (the so-called amendment to the Development Act) forced sellers to publish full prices, which in turn contributed to faster verification by buyers of the price level of flats introduced to the market.

In Q3 2025, developers introduced approximately 3,800 units to the residential market in Warsaw and sold over 4,100. The number of flats introduced is 6% higher than in the same period last year, but 3% lower than in Q2. As a result, the total number of flats on the primary market in Warsaw was nearly 17,000, only slightly lower than the number of flats introduced to the market in Q2.

Forecasted changes

The upturn in flat sales observed since the beginning of 2025 is partly due to the fact that many buyers were holding off on their purchase decisions in anticipation of the new support program and the announced interest rate cuts. Now that it is clear that the program only applies to the secondary market, demand for new flats may stabilize at a level adjusted to buyers’ increased creditworthiness. The last quarter brought very optimistic changes in macroeconomic factors – GDP growth, lower inflation and significant interest rate cuts, with moderate cost pressure in the construction industry.

In the last quarter of 2025, further sales growth can be expected, especially if inflation remains within 3% and interest rates fall again. In 2026, two or even three further interest rate cuts can be expected. This year should therefore bring further growth in sales across all markets and an improvement in the ratio of supply to current sales. An increased influx of building permit applications can also be expected before the end of the year (it is worth remembering that from the beginning of 2026, in accordance with the amendment to the act, projects submitted with building permit applications will have to include temporary shelters).